Introduction

Emergencies are inevitable. Financial crises are not.

Why This Matters

An emergency fund protects you from debt, panic, and instability.

A Real-Life Experience

Two families face the same car repair. One panics. One pays and moves on. The difference? Savings.

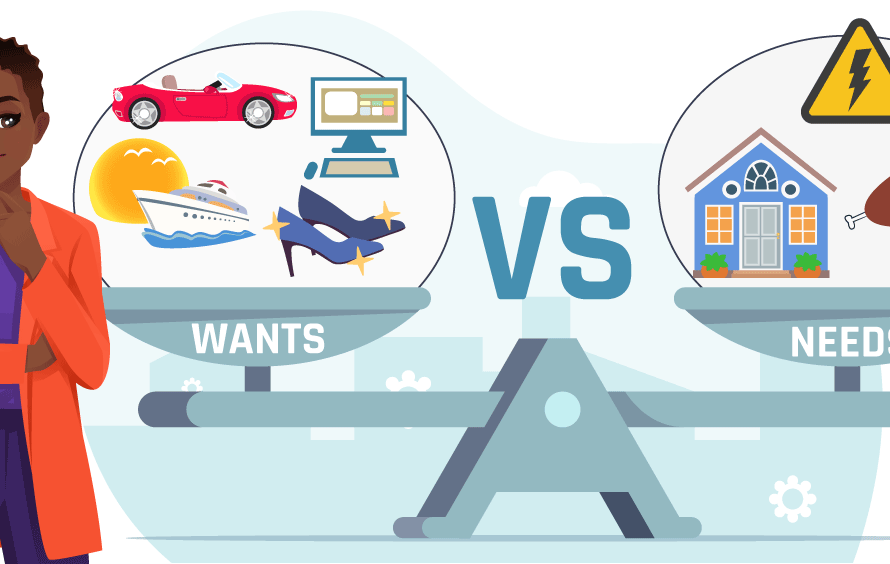

The Core Financial Lesson

Preparedness equals peace.

Key Takeaways

- Emergencies are predictable

- Savings reduce stress

- Small starts matter

Practical Steps

- Start with $500

- Automate savings

- Keep it separate and accessible

Reflection Questions

- What emergencies hit me most often?

- How would savings change my reactions?

SCB Closing

Emergency funds don’t prevent problems — they prevent disasters.